-

Effective strategic planning for the closely held business owner should begin with a formal valuation.

-

The information gathered and considered in a business appraisal provides insights into the business overlooked in day-to-day operations.

-

Valuation studies provide an insight into the potential value of the business and roadmap to to becoming a ‘best in class’ enterprise.

You own a business. You’re deeply familiar with your company’s day-to-day operations, challenges, and triumphs. You have invested your time, energy, and resources into its success.

You may have a rough estimate of what it is worth, guided by your years of experience, what you know of your industry, what you hear on the grapevine and your gut instincts. (Stastics tell us that more often than not, your beliefs are pretty inaccuate.)

Valuation: the First Step to a Successful Strategic Plan

The business owner who really wants to understand the value of a business and make informed decisions, you need an objective, data-driven analysis. This is where a formal business valuation is usually indispensable.

A formal valuation tells you the value today, of course. But to the the owners of the business, it is, or should be, much more than that number. A formal valuation conducted by a Certified Valuation Analyst (CVA) or other qualified professional is a full diagnostic exam for your business. It yields information you won’t get anywhere else.

I am a lawyer, a certified valuation analyst, and a certified exit and succession planner. I have worked with the owners of closely held businesses throughout my career.

Contact me if you have questions about valuing your business, developing an exit plan, or implementing the legal bulletproofing necessary to protect your investment.

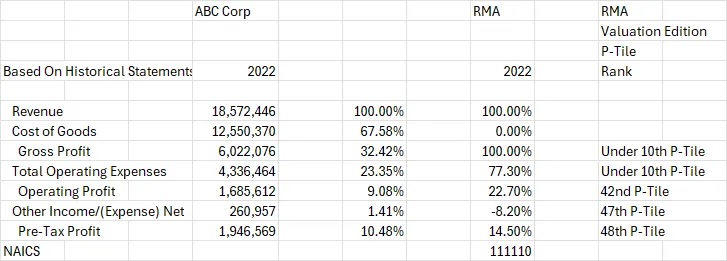

Here’s an example. A valuation focuses on comparisons to other similarly situation companies. Here is a snippet of analysis of key financial data from a calclulation report. It compares the performance of the company being valued with its competitors in the same industry in key areas using a percentage-based analysis.

A good, formal valuation drills down into a company’s financial and operational health, revealing insights that might otherwise remain hidden. This particular report tells us that this business is lagging on its ability to generate gross profits and that in other areas it is the middle of the pack.

Exceptional value in a business isn’t driven by mediocrity, and if and when the owners of this business try to find a buyer, these numbers will be reflected in a business that either cannot be sold or that is being sold at a much lower value than it could have brought.

The Business Divorce Law Report

The Business Divorce Law Report

Perhaps even more important, exit planning is good business. Thomas Deans, writing in Every Family’s Business, cautions that every business should be ready for sale every day and, if the price is right, the owners should consider a sale.

Perhaps even more important, exit planning is good business. Thomas Deans, writing in Every Family’s Business, cautions that every business should be ready for sale every day and, if the price is right, the owners should consider a sale.

A CEPA has access to this network of professionals, in and out of EPI’s network of advisors, and a thorough understanding of a proven strategy for business value enhancement that can increase the value of some businesses by 2–8 times when implemented.

A CEPA has access to this network of professionals, in and out of EPI’s network of advisors, and a thorough understanding of a proven strategy for business value enhancement that can increase the value of some businesses by 2–8 times when implemented.